Micro, Small & Medium Enterprises (MSMEs) form the backbone of the Ghanaian economy, and are drivers of socio- economic growth. MSMEs contribute between 60% and 70% to Ghana`s GDP, and 75% to 80% of total employment. Over 90% of SMEs in Ghana are informal; only 7% of the labour force comes from formal SMEs account for only 11% of GDP. In addition, 44% of those in the informal sector are unpaid (e.g. family members) and 20% are paid in kind.

These enterprises have the potential to diversify our economy which is currently dependent heavily on export of few commodities. Fortunately, we are currently witnessing a seismic shift to Ghana’s economic paradigm with evolving traditional career paths, and the allure of entrepreneurship capturing the imagination of today’s youth and young graduates, witha burgeoning ecosystem of startups and innovative ventures redefining the economic landscapes.

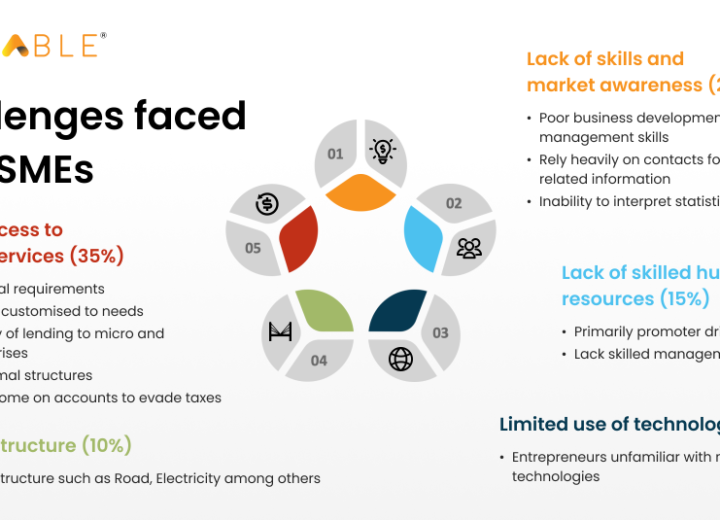

Indeed, Ghana actually needs the potential economic diversity provided by these startups and SMEs. SMEs therefore add tremendous diversity, provide import substitution, stabilize the local currency, create employment and has the potential to build resilient Ghanaian economy. Instructive to note that most of our artisans, farmer, traders, etc are in category of micro enterprises. Most MSMEs, and indeed, those being formed by the youth and young women lack access to affordable finance. This lack of access to finance, constitutes a big barrier to growth for SMEs. We need to effectively meet our enterprises with financial services.

Indeed, access to finance is a fundamental human right, and more so for our enterprises in the remotest parts of Ghana. Financial services provide the path to economic independence, enabling these enterprises to take advantage of emerging business opportunities to expand their existing business ventures, offer employment opportunities to the unemployed youth and providing livelihood, reducing economic hardship and poverty in our communities.